Faysal Bank is one of Pakistan’s most prominent financial institutions known for innovation in banking products and services. Unlike traditional peer banks relying on fixed interest rate slabs, Faysal employs a system of interest tiers pegged to average balance maintenance across its diverse savings accounts. This structure aims to incentivize disciplined savings habits among account holders, allowing the bank to maximize fund utilization simultaneously.

Article Highlights

Let’s examine how Faysal Bank incorporates dynamic interest tiers into major savings propositions for retail, priority and business customers:

Faysal Savings Account

The conventional Faysal Savings Account targets mass-market consumers seeking returns on surplus liquidity. Being interest-based, it may not fully comply for customers wanting strictly Shariah-compliant returns only.

For other customer segments, this savings account provides two average balance based tiers:

Tier 1: Below PKR 25,000

- No interest

- Minimum PKR 5,000 balance

Tier 2: Above PKR 25,000

- Interest paid annually

- Tier benefits unlocked

By stipulating a minimum threshold balance of PKR 25,000 to qualify for annual interest earnings, the structure nudges account holders to adopt financial discipline. Building adequate balances become more attractive due to associated returns.

For Faysal Bank, larger consolidated deposits reduce overall funding costs freeing up capital for commercial opportunities. This optimizes asset utilization to be shared with customers as interest earnings in higher tiers.

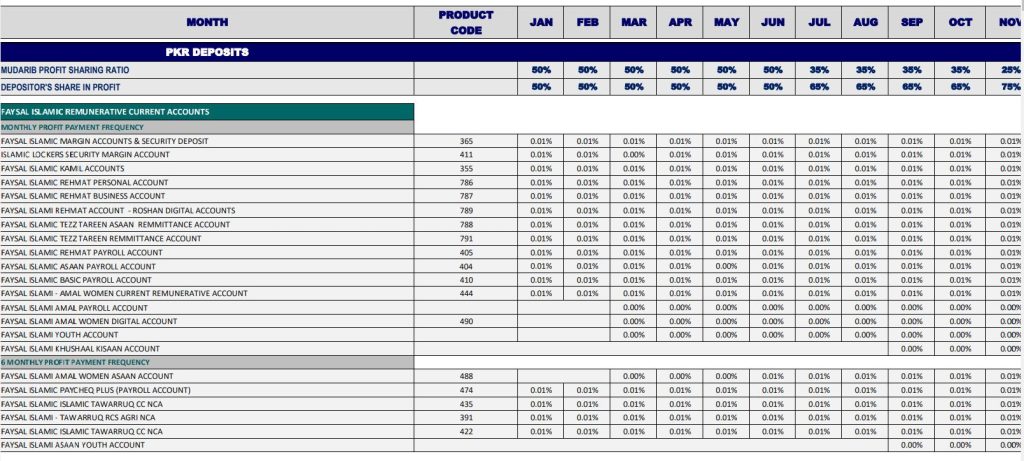

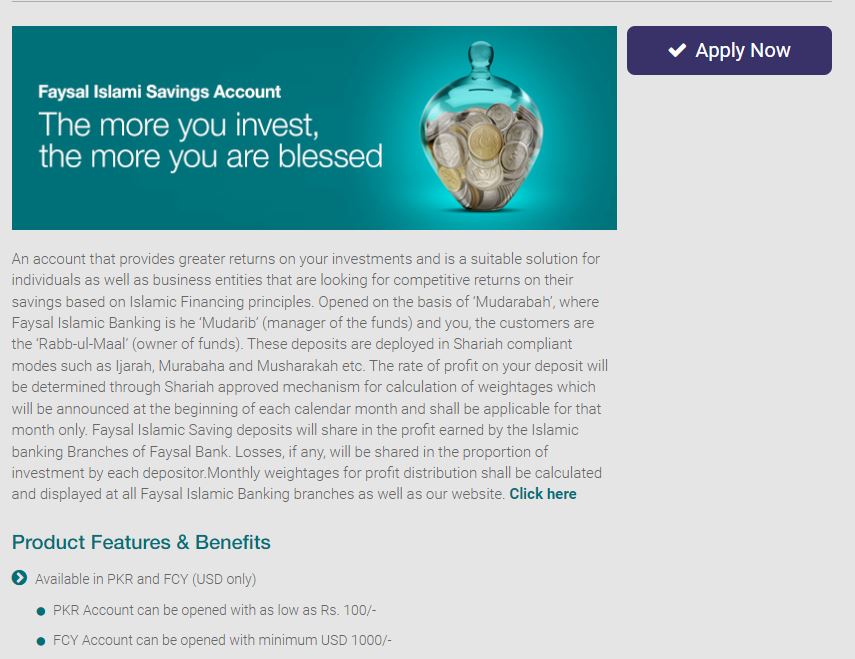

Faysal Islamic Savings

Faysal also offers a full-fledged Islamic Savings Account for customers preferring returns from Shariah-compliant investment accounts only. The proposition is structured around three profit-based tiers instead of guaranteed interest:

Tier 1: Up to PKR 10,000

- No profit payment

Tier 2: PKR 10,000 – PKR 500,000

- Half yearly profit payment

Tier 3: Above PKR 500,000

- Quarterly profit payment

To qualify for profit share, the minimum threshold balance is PKR 10,000 – promoting financial discipline basics among account holders from the outset.

Apply NowBy maintaining over PKR 500,000 as average balance, customers reach the highest tier allowing more frequent quarterly profits. concentrated floats boost funds with Faysal Islamic to deploy in Halal investment opportunities for potentially higher gains.

Faysal Business Savings

Faysal has also created specialized savings accounts for the fast-growing SME and business banking customer segments.

The Faysal Business Savings Account employs four tiers with corresponding pricing incentives:

Tier 1: Up to PKR 2.5 million

- Standard cheque book pricing

Tier 2: Over PKR 2.5 million

- 25% off cheque book pricing

Tier 3: Over PKR 5 million

- 50% off cheque book pricing

Tier 4: Over PKR 10 million

- 75% off cheque book pricing

- Dedicated RM and account services

Business customers parking higher average balances enjoy increasing tiers with associated rewards like discounted business account chequebooks and dedicated relationship management.

For Faysal Bank, larger consolidated business deposits allow cross-selling other lending solutions to the enterprise ecosystem profitably- further incentivizing building business savings portfolios innovatively.

Also read: NBP Bank Savings By Interest Tiers

Conclusion

From conventional to Islamic and SME savings accounts, Faysal Bank relies extensively on incentivizing average balance tiers for driving financial inclusion. Minimum thresholds nudge account holders towards disciplined saving while concentrated funds allow the bank deployment flexibility towards fruitful commercial ends. Thus, dynamic interest tiers enable Faysal Bank to align wider goals around savings penetration and deposit mobilization with attractive value propositions suiting diverse customer needs.